- AI Chatbots for Banking and Customer Support

- AI Chatbots for Fraud Prevention & Security

- AI Chatbots for Personal Finance & Wealth Management

- AI Chatbots for Financial Institutions & Enterprise Banking

- AI Chatbots for Lead Generation & Customer Engagement in Finance

- How to Choose the Right Finance Chatbot

Banking and the financial sector are quite conservative, but AI tools are changing the rules of the game even for them. It is a development driver that is opening up new ways of attracting new customers and meeting the needs of existing ones right before our eyes. AI can do everything from automating and personalizing customer service to enhancing internal operational issues.

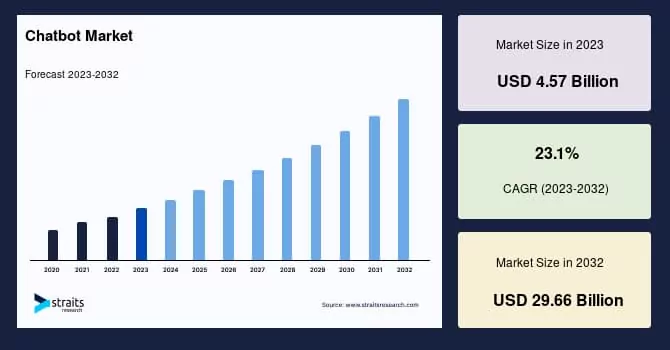

In 2024, the chatbot market size was $7.57 billion. The growth is only going to continue!

The pandemic, lockdown, and other cataclysmic events have contributed to this surge and changed consumer behavior. They don’t want to wait and waste time in queues. They want to quickly accomplish familiar tasks, conveniently and easily order goods, and pay online. And this is where artificial intelligence takes center stage. This is where we see the revolution of the banking and financial sectors. It helps financial institutions optimize all processes, from credit decisions and fraud detection to cybersecurity and financial risk management.

In this article, we will explore what an AI chatbot for finance is, how such solutions improve customer experience, and what options are available on the market. We’ll also look at 17 AI chatbots that are working in the banking sector and financial services market today.

Ready to learn more? Then let’s get started!

What Is Finance Chatbots?

AI chatbot fintech is a virtual assistant that mimics a conversation with a human, instantly providing relevant information or personalized recommendations. They use artificial intelligence (AI) and natural language processing (NLP) to understand and respond to customer queries in real time.

The AI chatbot for finance can have different business goals:

- Better service. Chatbots are available 24/7 and can handle a large number of requests at the same time, which significantly reduces wait times.

- Counseling. AI chatbots introduce banking products, provide advice on financial services, loan terms, deposits, and other instruments.

- Personalized banking. Traditional banking is not always able to satisfy sophisticated consumers. Finance AI chatbot analyzes customer behavior and provides them with individual banking offers.

- Cost reduction. Service automation with AI chatbots reduces call center costs and operator salaries.

- Fighting fraud. AI quickly analyzes huge amounts of data, which allows to identify suspicious and atypical fund transfers or online payment transactions.

- Increasing sales. An AI chatbot for finance can be an effective way to attract new customers or help existing customers make decisions about banking services.

- Increased efficiency. Chatbots automate many routine tasks of bank employees.

- Data collection. AI chatbots can collect information about customers, their preferences and financial situation. This data can be used to improve customer service and marketing campaigns.

As you can see, an AI chatbot fintech can solve a wide range of tasks. But how exactly does it operate in practice? Next, let’s look at specific examples of AI chatbots in banking.

AI Chatbots for Banking and Customer Support

AI chatbots in finance, for banks, and customer support are virtual assistants that work around the clock and handle a large number of requests simultaneously, track transactions and handle customer interactions. This makes customer service more efficient.

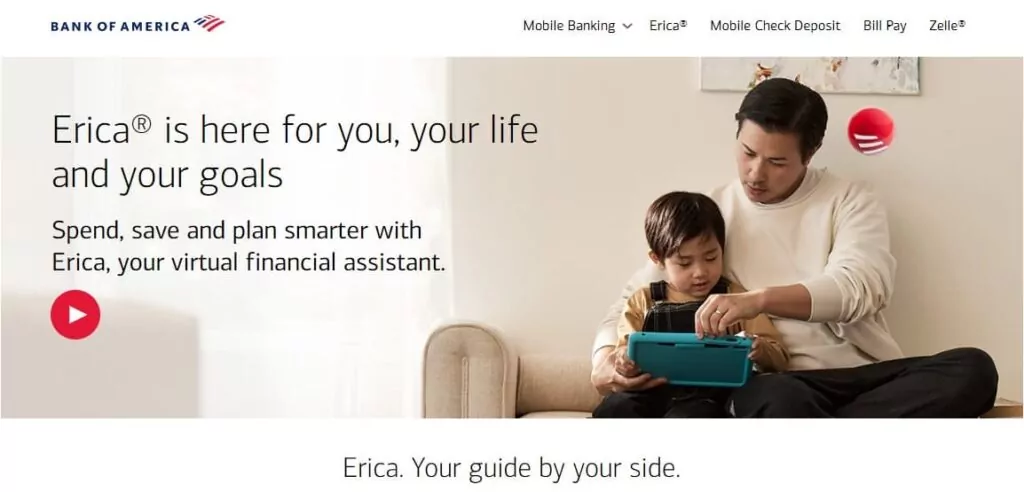

1. Erica by Bank of America

Bank of America launched Erica virtual financial assistant in 2018. According to BofA, 42 million users have made 2 billion interactions since launch, and the virtual assistant has answered 800 million queries… Erica answers 98% of questions within 44 seconds on average. Every day, customers contact the bot 2 million times. These are unattainable numbers for customer service.

This finance AI chatbot acts as a virtual assistant that provides account information on demand, as well as tracks transactions, reminds customers about their accounts, and sends notifications when double debits occur. Erica can be interacted with in a variety of ways, including text messages or voice commands.

Features

- Searches on-demand for past credit and debit card transactions;

- monitors recurring expenses;

- with Erica, Merrill investment account holders can access quotes, track results, make trades, or contact a Merrill advisor directly in the app;

- unexpectedly for a finance AI chatbot, but the fact is that Erica has a sense of humor. It occasionally jokes around with clients.

Pros

- Assists clients in understanding their spending behavior;

- provides weekly updates on monthly expenses;

- reminds them to make scheduled payments;

- FICO® Score Insights notifies customers of credit score changes.

Cons

- Erica is available in English only and exclusively on the Bank of America® Mobile Banking app.

Pricing

Erica is available for free in the latest version of the Bank of America® Mobile Banking app. The app is available for download for U.S. cell phone number holders.

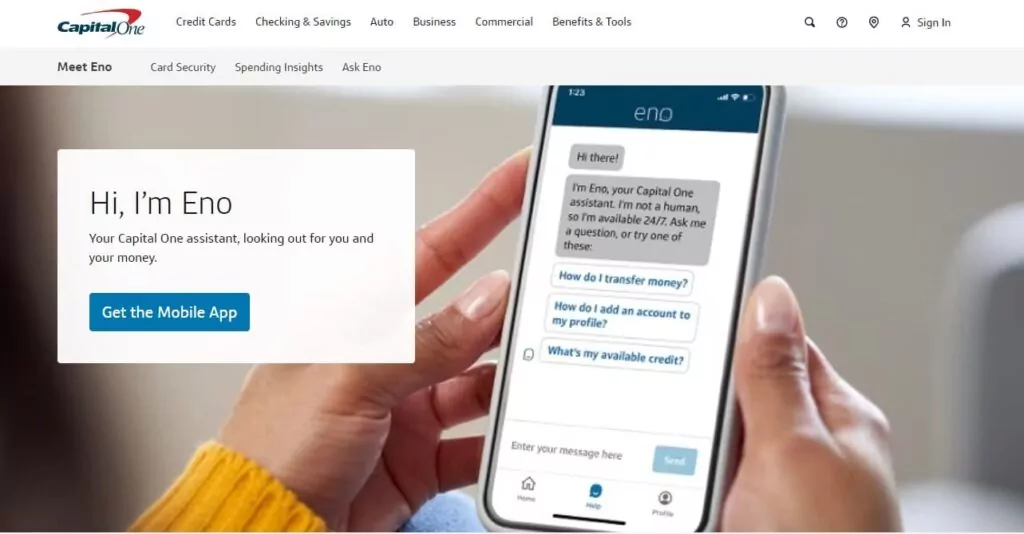

2. Eno by Capital One

Eno, an AI chatbot fintech, answers questions in Capital One’s mobile app and web banking online. It not only helps manage finances but also monitors security to detect and prevent fraud in time. Among the security measures are two-step authentication, card blocking function, and real-time alerts for unusual or suspicious payments. This finance AI chatbot responds after short requests-responses “account balance” (or “bal”), “transactions” (or “trans”), “available credit” (or “cred”), “payment date” (or “date”), etc. According to the developers, Eno has a great sense of humor and loves puns. When asked, it shares jokes and anecdotes with users.

Features

- Creates virtual card numbers for specific merchants when shopping online with the desktop version, greatly reducing the risk of merchant fraud;

- tracks the end of the free trial period for most subscriptions, allowing you to cancel your subscription before your payment is charged;

- controls automatic recurring payments.

Pros

- Sends notifications after double debits and makes recommendations on how to resolve the issue;

- analyzes expenses and tracks recurring payments;

- send spending data to your email and notifications to your smartwatch.

Cons

- Available in English only;

- users say there are sometimes technical problems with the desktop extension.

Pricing

Eno is available in the Capital One Mobile app, which is free to use.

3. Kore.ai Banking Assistant

The ready-to-deploy virtual banking assistant automates and optimizes Service Experience, Customer Experience, and Accessibility Experience. The platform offers more than 250 ready-to-use options, including a finance AI chatbot for digital banking or call center automation and answering customer queries. With Workbench solutions, you can quickly customize your virtual assistant to fit your specific brand.

Features

- Generates dynamic and human-like responses tailored to specific audiences;

- integrates with existing systems, including popular LLMs or client companies’ proprietary solutions;

- provides real-time contextual customer information when used for call center automation.

Pros

- Contains prompt templates for multilingual and personalized responses;

- call center employees can search for answers in the created knowledge base during the call;

- extracts data from conversation analytics.

Cons

- May have difficulties customizing integrations.

Pricing

Ready to deploy virtual banking assistant costs +5¢ per session. Information on customized quotes for projects and access to a demo of the AI platform is available upon request.

4. Ceba by Commonwealth Bank

Finance AI chatbot, developed by Commonwealth Bank Australia, performs more than 200 banking transactions, from activating a card to getting cash without a card. Ceba recognizes about 60,000 query variations and provides detailed answers to questions such as “Where are my bank statements?” or “I’d like to pay my bill”.

Features

- A one-stop support center for solving customers’ banking needs;

- allows you to block or cancel your card, as well as dispute the transaction;

- available 24/7 for all bank customers.

Pros

- Redirects inquiries to specialists or connects to a customer service agent when necessary;

- using the app, bank customers can trade Australian shares and explore content about investing;

- Money Plan helps control spending and savings.

Cons

- Available exclusively to Commonwealth Bank customers.

Pricing

Available in the NetBank and CommBank apps.

5. LivePerson Conversational AI

LivePerson’s conversational AI platform has many different features that can transform banking services and customer experience. Conversational banking tools can be used to provide personalized advice or redirect customers from waiting lines to more convenient communication channels, providing exceptional customer experience and human interaction. Yes, conversational AI can do this and more.

Features

- Advanced Intent Manager analytics updates customer data in real time to help you understand customer intent;

- uses Conversation Builder® to create AI chatbots and automated flows without writing code;

- enables multi-channel engagement across multiple channels, including mobile devices, messengers, and social media;

- Proactive Messaging offers users promotional offers and discounts.

Pros

- Conversational solutions make customer self-service as easy as possible: auto payments, cancel payments, check account balances, ability to replace cards, fraud alerts, and automated loan pre-approval process.

- a finance AI chatbot integrates with Salesforce, Microsoft Dynamics, NetSuite, SugarCRM, Zendesk, and Adobe Experience Cloud and connects to any CMS via API or ready-made connectors to ensure a continuous data flow;

- The Report Center offers out-of-the-box reporting features to evaluate chat transcripts and the effectiveness of conversational AI and human communication across channels.

Cons

- Some users have noted difficulties with the Safari browser.

Pricing

Pricing for Bronze, Silver, and Gold plans is available upon request.

AI Chatbots for Fraud Prevention & Security

Security is at the core of banking and financial transactions, even more so when making online payments. AI chatbots help protect consumer data and money by detecting suspicious activity and fraudulent schemes.

6. Amelia [formerly IPsoft]

Amelia is a conversational AI platform. The developers offer two types of virtual assistants for financial institutions — Action Agents and Action Agents. Their main areas of use can be reduced to two categories: interaction of customers and employees with financial companies and automation of tasks and repetitive requests to reduce specialists’ workload in contact centers. When integrated with banking solutions, Amelia AI transforms digital banking.

Features

- Amelia AI Agents are powered by Generative AI, Deterministic AI, and RAG to recognize customer intent;

- Amelia AI Agents are equipped with out-of-the-box financial skills and trained in hundreds of financial scenarios, tasks, and skills, including making payments, finding ATMs, and fraud alerts;

- based on the conversational AI platform, enterprise AI agents can be created to serve customers across all voice and chat channels.

Pros and Cons

- Supports over 100 languages and communicates naturally with customers;

- generates instant responses to user queries by connecting to existing content ecosystems;

- average response time of less than 1 minute.

Pricing

Demo and pricing are available upon request.

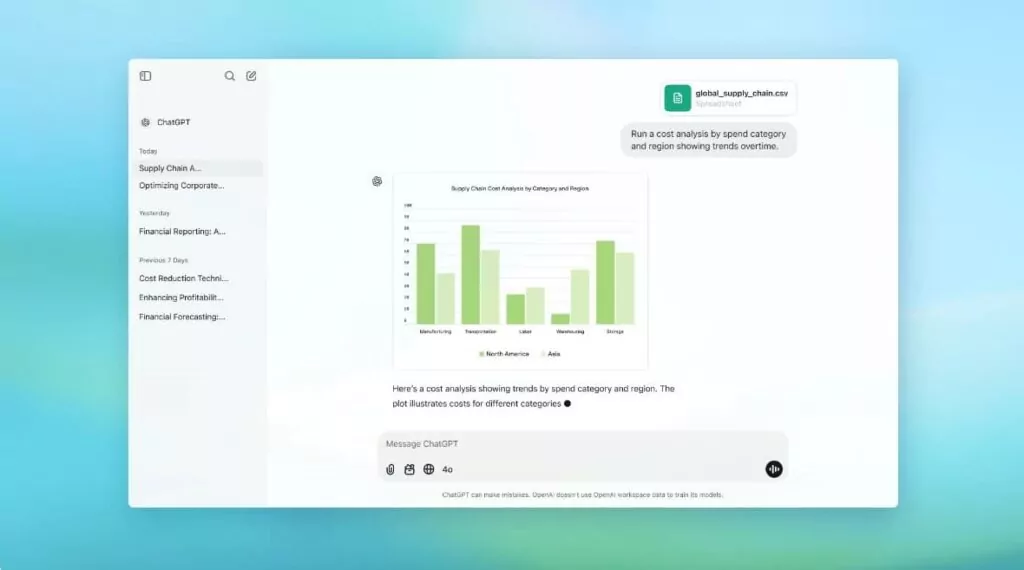

7. ChatGPT Enterprise for Finance

ChatGPT Enterprise is the most powerful version of ChatGPT today. OpenAI offers a variety of ways to use its AI tool in financial organizations: analyzing massive amounts of financial data, identifying patterns and forecasting, compliance, reporting, and creating a finance AI chatbot for automated customer interaction.

Features

- The Code Interpreter feature analyzes any information in seconds;

- ChatGPT Enterprise can be used to create chatbots to answer customer questions, provide information about products and services, process loan applications, check credit history, advise customers on insurance or retirement planning;

- suitable for analyzing financial data and identifying suspicious transactions.

Pros

- A convenient analytical dashboard for analyzing usage;

- provides an administrator console with bulk member management;

- Enterprise users get unlimited access to advanced data analysis;

- integrates with applications already in use in workflows.

Cons

- ChatGPT lacks critical thinking and can be biased.

Pricing

ChatGPT Enterprise pricing is available upon request.

8. Posh AI

The Posh platform offers several AI solutions for the banking industry, including virtual assistants to improve customer experience and operational efficiency. Posh AI assistants enable bot personalization, automate routine banking tasks, reduce wait times, decrease response rates by 92%, resolve 91% of queries without a live agent, and limit contact center costs.

Features

- Knowledge Assistant provides instant answers for live chat with customers and provides 24×7 support for any query;

- Voice Assistant in finance AI chatbot can greet callers, answer frequently asked questions, provide seamless banking service over the phone, verify caller identity to prevent fraudulent activities;

- Digital Assistant is designed specifically for the banking sector. An AI chatbot handles customer queries 24/7 on website and mobile banking and transfers them to real agents when required.

Pros

- Each Posh assistant can be customized to meet the needs of a specific bank, providing customers with a natural interaction;

- offers flexible automation and self-service options, including checking balances, making payments, and obtaining loan and repayment information;

- verifies user identity using PIN codes or one-time passwords from SMS, providing customers with security.

Cons

- Difficulties may arise at the initial stage of using the solution.

Pricing

The demo version and pricing are available upon request.

AI Chatbots for Personal Finance & Wealth Management

Such AI chatbots in finance help users with budgeting and financial planning, provide personalized investment advice.

9. Haro by Hang Seng Bank

The virtual assistant is developed by Hang Seng, one of the largest banks in Hong Kong. The HARO AI chatbot solves banking and secure transaction issues 24/7. It works on Hang Seng Bank’s website, Hang Seng Personal Banking App, and WhatsApp.

Features

- FX updates, market forecasts, credit card offers, and Green Receipt service, as well as search for nearest bank branches and ATMs are available on HARO WhatsApp;

- at the command of the finance AI chatbot, HARO transfers funds to third parties or to clients’ own accounts;

- dynamics of expenses and visualization of account balance with the help of charts is also available to simplify financial planning.

Pros

- AI chatbot for finance includes currency exchange, travel, health, and life insurances;

- supports accelerated payment system;

- answers questions about investments and loans.

Cons

- Supports Traditional Chinese, Simplified Chinese, Cantonese, and English.

Pricing

Available free of charge for bank customers.

10. Virtual Financial Assistant powered by Abe.ai and Envestnet | Yodlee

The pre-built virtual financial assistant powered by Abe.ai AI-driven conversational technology is designed exclusively for the financial industry. It enables banks to send proactive notifications and recommendations to customers to influence their financial habits and spending in real time. Banks can get deep analytics on their customers’ habits.

Features

- Feature-rich virtual financial assistants [VFAs] operate across all digital channels — website, online banking, mobile app and messengers;

- off-the-shelf VFA options and customized AI packages for chatbots and conversational banking are available;

- voice channels, proactive recommendations, and personalized messaging engage consumers and drive app usage.

Pros

- Users can set financial goals, manage budgets, and track their spending for their own financial well-being;

- embedded AI is trained on financial data, communicates naturally, answers basic questions, provides personalized information to customers, and can interpret queries and select appropriate actions based on context;

- cloud-based platform with out-of-the-box VFAs integrates with banking systems and contact center platforms.

Cons

The solution can be expensive.

Pricing

Abe.AI pricing plans vary depending on the specific solution. Pricing information is available upon request.

11. Personetics

The Personetics platform offers AI tools for proactive financial management. These are financial institutions solutions that don’t just serve customers and analyze their financial behavior, but help them achieve financial goals, increase engagement and deposits, build trust and loyalty.

Features

- Personetics Engage, with a library of ready-made custom scenarios and banking-specific triggers, provides users with real-time data, predictive balances, and personalized advice to anticipate problems and take timely action to address their financial situation;

- with Engagement Builder, banks can quickly deploy a solution, manage analytics, and offer customers services that meet their needs;

- Personetics ACT, smart journeys, financial activity trackers and personalized advice encourage savings for customers of different ages, adapt to their needs, financial activity and preferences, help them set, manage and track multiple financial goals, including savings accumulation.

Pros

- Financial Recap provides Instagram-style summaries of spending over the past seven days;

- Personetics + Q2’s personalized engagement platform integrates with out-of-the-box UX widgets and flexible customization options;

- over 100 hyper-personalized insights and tips are based on each customer’s transactional analysis;

- SaaS system can be deployed in 12 weeks on the Personetics Azure cloud.

Cons

- Users note the complexity of configuration in terms of customer experience.

Pricing

Pricing upon request.

12. BankBuddy.AI

The BankBuddy platform offers financial institutions a complete digital banking solution. Off-the-shelf AI solutions enable banks to launch a digital banking platform in 12 weeks and offer services across all channels [online banking in all browsers, mobile apps, social media channels] for a seamless customer experience.

Features

- Over 220+ ready-made customer pathways for retail and corporate banking;

- provides users with instant automated recommendations, customized offers and campaigns for cross/supplemental sales and retention;

- omnichannel finance AI chatbot delivers personalized information to customers and transfers data, conversation context, history, and customer profile to a human agent.

Pros

- Built-in analytics across all stages of the customer lifecycle, campaigns, channels, real-time reports, and statistics to track chatbot performance, customer behavior, and goal achievement;

- automatically extracts chat history, internal notes, and tags for a 360° view of customers;

- uses text, video, and images for a hyper-personalized customer experience.

Cons

- May have difficulty mastering platform features and integrating with tools already in place.

Pricing

Pricing upon request.

AI Chatbots for Financial Institutions & Enterprise Banking

24/7 online assistants answer common customer questions, help customers make payments, and can offer personalized financial advice. They make banking convenient and accessible round the clock, saving time and money for both customers and banks.

13. Kasisto [KAI]

KAI Consumer Banking offers the financial sector solutions for customer service and automation of employee training or routine operations. The tool generates answers based on the created database and localized content specific of the bank.

Features

- KAI Answers is based on KAI-GPT — a large language model specially developed for the banking industry, which can be integrated into existing AI Agents or chats;

- KAI-GPT generates answers about banking products, services, and procedures based on downloaded internal policies, regulations, banking procedures, web content, and complex financial products;

- KAI Answers is suitable for automating the team work, searching for answers or documents and providing links to answer sources;

Pros

- Finance AI chatbot processes inquiries on accounts and money transfers, provides personalized recommendations and up-to-date information on customers’ financial habits;

- KAI Consumer Banking is a solution for creating and “humanizing” unique AI agents that match a specific financial institution’s brand and cover the entire customer digital financial journey, from support questions to long-term financial planning;

- for financial institutions operating in Spanish-speaking markets, KAI comes with a set of conversational Spanish services.

Cons

- Users report difficulties in setting up and generating reports.

Pricing

Price upon request.

14. Clinc

Clinc’s conversational AI helps banks automate communication with users and make the interaction as human as possible. The tool can be integrated with existing systems on a plug-and-play basis and deployed in the cloud and on-premises. The developers offer options for ready-made and enterprise Clinc’s conversational AI platforms — a proprietary stack of technologies that enable voice and text interactions.

Features

- Clinc AI understands and tracks complex conversations, preserves history and context, which ensures high-quality interactions with customers;

- transactions can be carried out by voice;

- in the chatbot, you can check your balance, block or unblock cards, view your spending history, transfer funds, and get information about your financial habits.

Pros

- The Finance AI chatbot recognizes slang and understands contextual clues, which makes communication natural and allows the system to understand all queries related to banking topics;

- Clinc’s Virtual Banking Assistant can be deployed in a few days or weeks, as it seamlessly integrates with front-end and back-end systems, as well as with your BL;

- Clinc’s Public Banking Agent is ready for use with unauthenticated customers and visitors, providing convenient self-service and answering frequently asked questions.

Cons

Pricing

Demo and pricing are available upon request.

15. IBM watsonx Assistant for Finance

IBM watsonx Assistant is an AI chatbot builder powered by artificial intelligence that transforms the digital banking experience. It provides customers with fast, convenient, and seamless self-service, offering a wide range of banking operations from branch locators to personalized offers, including financial advice. No programming skills are required to launch this chatbot.

Features

- The conversation builder contains ready-made templates for banks;

- special data security measures ensure the safety of bank data;

- watsonx assistant uses natural language processing, which ensures natural interaction and allows real-time response in any language.

Pros

- With an intuitive platform, you can get started in a few minutes;

- you can customize your chatbot to match your brand’s visual identity and personality, then intuitively integrate it into your bank’s website, mobile apps, Facebook Messenger, Intercom, Slack, WhatsApp, Hubspot, WordPress, and more;

- with ready-made templates, integrations, and drag-and-drop tools, a visual chatbot builder speeds up the creation of conversation flows and various scenarios, as well as customizing user actions;

Cons

- Users note the high cost of the solution, the longer time it takes to set up the system, and the technical skills required to use the platform effectively.

Pricing

- Free plan;

- Plus plan — at USD 140/month;

- Enterprise plan with advanced features of the Plus plan — price upon request.

AI Chatbots for Lead Generation & Customer Engagement in Finance

These bots help banks and other financial institutions generate leads and retain existing customers by offering a high-quality service. They answer customer questions and help them choose financial products and services, as well as collect information about them for further marketing campaigns.

16. Drift Chatbot for Finance by Salesloft

Drift Chatbot is a conversational AI chatbot that turns website visitors into loyal customers, increases their engagement, and provides an unrivaled experience. On the platform, you can model, test, and launch a unique chatbot in less than 48 hours.

Features

- Drift Intel instantly recognizes qualified leads and provides important information about visitors (company name, industry, number of employees, location, etc.) and automatically creates personalized messages for greeting;

- Drift Bionic Chatbots use AI to generate personalized, accurate answers to website visitors’ questions. Provides real-time responses that are aligned with the brand’s ToV and automatically routes qualified leads to sales;

- live chat allows you to engage with visitors BEFORE filling out a form.

Pros

- Instantly routes real user responses to the right person;

- custom chatbots take seconds to set up. They engage website visitors with custom-made personalized messages and interactions, answer questions, and even book appointments;

- Drift has the option to A/B test different messages.

Cons

- Additional training and technical expertise may be required to create, customize, and integrate a unique chatbot with other platforms.

Pricing

Advanced and Premier plans are available upon request.

17. Haptik Finance Chatbot

Haptik develops an AI chatbot fintech based on Smart Skills technology, created specifically for the financial industry. AI chatbots can send users notifications about their financial situation, accounts, and suitable investment strategies, recommending additional financial products or services based on their behavior and preferences.

Features

- Haptik chatbots support over 130 languages and communicate naturally in a personalized manner across WhatsApp, SMS, Messenger, Google Business messages, Instagram, and Facebook at every stage of a user’s financial journey;

- integrates seamlessly with Genesys, Avaya, Zendesk, Freshcaller, Cisco, contact centers, CRM;

- uses video, voice, and live conversations to engage leads in meaningful conversations, understanding their unique financial needs and preferences.

Pros

- Haptik chatbots powered by GPT collect feedback in real time;

- its library contains over 100 pre-built conversation workflows;

- Haptik GPT-first engages customers in live conversations and makes personalized recommendations that match their preferences and budget.

Cons

- The lack of technical skills may result in complexities during the integration stage.

Pricing

The demo version is available upon request.

How to Choose the Right Finance Chatbot

Choosing the AI chatbot for finance is a key step to a successful digital transformation of banking services. To ensure that your chatbot truly brings value, it is important to consider several critical factors.

- Security and compliance. Ensure that the chatbot complies with all necessary financial regulations, such as GDPR, PCI-DSS, and other security standards. Customer data protection is paramount.

- AI capabilities. Look for solutions that use advanced natural language processing [NLP], machine learning, and real-time analytics. This will allow the finance AI chatbot to understand complex queries, adapt to customer needs, and provide personalized responses.

- Integration. The AI chatbot for finance should easily integrate with existing banking systems, CRM, fraud detection tools, and other platforms.

- Scalability. Make sure that the solution you choose can handle large volumes of customer requests without sacrificing performance.

AI tools are already successfully used in the banking and finance industry. Further implementation of AI chatbots can really lead to big changes in the market. There is no escape from progress. All that remains is to use new opportunities to the maximum to stay ahead of the competition.

With Omnimind.ai, you can easily and simply create an AI chatbot for your business! On the platform, you will get all the necessary tools to create a unique corporate best AI chatbot for finance.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.